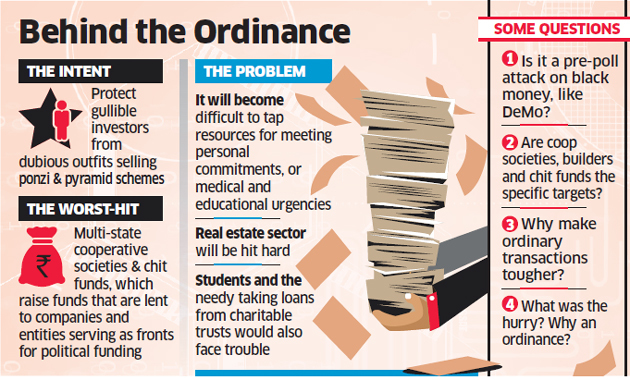

‘The Banning of Unregulated Deposit Schemes Ordinance, 2019’, notified last week, may be intended to protect gullible investors from dubious outfits selling ponzi and pyramid schemes, but the timing of its enactment and likely ramifications have stunned experts. Some have compared it with demonetisation, which was aimed at curbing black money and announced less than three months before the 2017 Uttar Pradesh elections.

The law permits deposits from ‘relatives’, banks, financial institutions, property buyers, customers (extending an advance payment), and for other designated purposes. Similarly, a proprietor can borrow from a non-relative as long as it is strictly for business purposes.

“However, the ability to augment resources for meeting personal and social commitments, (or) medical and educational urgencies will dry up as no amount can be borrowed from persons other than relatives as defined under the Companies Act. The definition is restricted to only immediate family members,” said senior chartered accountant Dilip Lakhani.

No Threshold Amount

“The real estate sector will be hit hard as deposits can only be accepted for a designated transaction and can be adjusted against the future sale consideration. Even if the intention of the ordinance is laudable, the language could cause difficulties to small traders carrying out business as a proprietor, partnership firm or LLP. Students and the needy taking loans from charitable trusts would (also) run into hurdles,” said Dilip Lakhani.

Significantly, the law prohibits deposits by non-voting members in multi-state cooperative societies. Based out of various states, such societies, along with chit funds — masquerading as quasi-banks — are suspected to have raised large amounts that are then lent to companies and entities that serve as fronts for political funding. In enforcing the ban, the ordinance has brought about amendments to the Reserve Bank of India Act, 1934, and Multi-State Cooperative Society Act, 2002, to explicitly state that “...a multi-state cooperative society shall not be entitled to receive deposits from persons other than voting members”.

“It’s unclear what’s the new mischief that they (the government) are trying to deal with, and why it warranted an ordinance. Many bona fide transactions, particularly for SMEs, would be impacted due to the sweeping nature of the provisions... (I) don’t know whether there was enough consultation before moving the ordinance,” said Jayesh H, cofounder of law firm Juris Corp.